CashX CPS NG

Offer Details: | |

|---|---|

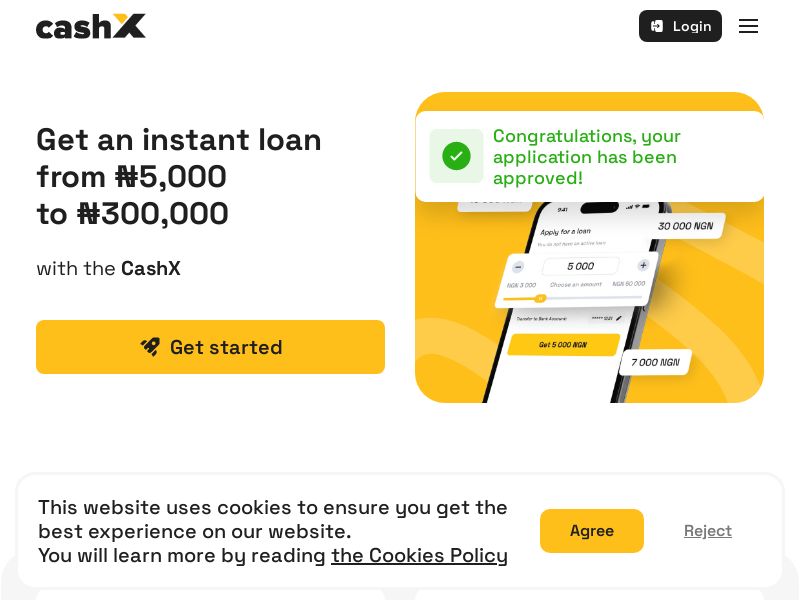

| Offer Name: | CashX CPS NG |

| Payout: | $1.60 / cps |

| Preview: | Preview Landing Page |

| Categories: | |

| Network: | LeadBit |

| Last Updated: | Jan 25, 2026 |

| Countries: | NG |

Target audience: Age: 20-50 years old

Gender: 60% men, 40% women

Income level: average or below average ($1,000–2,500 per month)

Location: cities with a population of over one million (Lagos, Abuja, Port Harcourt)

Need: short-term loans (up to 30 days), average loan amount – NGN 20,000–150,000

Main motivation: financial flexibility, covering urgent expenses

Channels of attraction: mobile apps, social networks (Facebook, Instagram, TikTok), Google Ads. Android/iPhone users.

*Targeting tips:

(FB) Core target audience – men, 20-45 years old. Android/iPhone users. It is better to test from broad to narrower segments.

(Google) 20+ years old, no other restrictions.

Advantages of the offer:

Quick approval

Data security

User-friendly interface

Low interest rates

24/7 application review

Loan terms

Loan amount: From 5,000 NGN to 300,000 NGN

Loan term: For first-time customers, either 10 days, 15 days, or 20 days. For repeat customers, 10 days, 15 days, 20 days, or 30 days.

Interest rate: From 2% per day to 4% per day.

Working hours: Monday – Friday: 8:00 a.m. to 8:00 p.m.

Saturday: 9:00 a.m. to 6:00 p.m.

Sunday: 1:00 p.m. to 5:00 p.m.

Loan applications are reviewed 24/7

Permitted traffic channels:

Content projects

Banner advertising

Mobile traffic

Contextual advertising

SMS mailings (after approval of templates)

Email mailings (after approval of templates)

Social networks

Retargeting through traffic partners

Prohibited traffic channels:

Contextual advertising for the Client's trademark, trade name, and/or brand.

Motivated traffic

Adult traffic

Doorways

Toolbar

Clickunder

Popunder

Push notifications

List of requirements in accordance with advertising law:

Full disclosure: Advertising materials must provide consumers with clear and complete information about the terms of the loan, including interest rates, fees, repayment terms, and other important details. Prohibition of misleading advertising: It is prohibited to use advertising that may mislead consumers about the actual terms of the loan or create a false impression of the profitability of the offer. Compliance with transparency standards: Advertising must be understandable and not contain complex

LeadBit

Hello! We are a trusted and high-perspective Affiliate Network. Members of our affiliate network are Webmasters & Advertisers.

Publisher Benefits:

- Simple lead forms

- Stable and high payouts

- Testing and optimization promo

- Your personal manager helps you with any question

GEO: Europe and around the world

Advanced Analytics